Key Takeaways

1. Timely Payments and Cash Flow Optimization: Adhering to a well-structured payment schedule and utilizing early payment options can significantly enhance a company’s cash positions and overall financial health.

2. Advanced Procurement Software: Implementing sophisticated procurement software aids in managing accounts payable, preventing overpayment and double payment, and streamlining the entire procurement process.

3. Strategic Use of Payment Methods: Diverse payment methods, including cash in advance and letters of credit, provide both buyers and suppliers with secure and flexible payment options that mitigate risks and support reliable transactions.

4. Resolving Payment Disputes: Proactively addressing payment disputes and ensuring timely payments as per the purchase contract fosters trust and reliability, enhancing relationships with suppliers and maintaining smooth operations within the supply chain.

As a manager or director of procurement, sourcing, purchasing, or the supply chain department at a business, you know how important it is to maintain a good relationship with your suppliers. One of the key factors in this relationship is the payment terms. Suppliers generally want to be paid as soon as possible, while the business wants to hold onto its money for as long as possible. Negotiating payment terms can help ensure a successful working relationship. When a supplier receives a purchase order, certain terms and conditions apply to all invoices received. The payment terms are used to calculate the date on which an invoice is received, and if any information is missing on a business invoice, the payment term is calculated once.

Strategic goal-setting with suppliers is a powerful tool in effective procurement practices. It goes beyond just trying to strike favorable deals and instead focuses on building collaborations that can take your procurement process to new heights. Clear and consistent payment terms can benefit both the supplier and buyer in the short and long term. For sample orders, it’s common to pay the total amount upfront as it has a lower value and helps the supplier start production and delivery quickly.

Overview of Procurement Payment Terms

Procurement payment terms are a critical aspect of managing the financial dynamics between buyers and suppliers within a supply chain. They define the conditions under which a vendor will be paid for their goods or services, impacting cash flow, efficiency, and overall business relationships. Clear and well-structured payment terms help ensure that both parties understand their financial obligations and timelines, fostering trust and reliability within the supply chain.

The purchasing department plays a pivotal role in this process, overseeing the creation and management of purchase orders. These formal requests outline the types, quantities, and agreed prices for products or services. Accurate and detailed purchase orders are essential for preventing payment disputes and ensuring that the terms agreed upon during procurement are honored. One common method of payment is payment in advance, where the buyer pays the supplier before the goods or services are delivered. This method minimizes risk for the supplier but can strain the buyer’s cash flow.

Several payment methods and terms can be negotiated between the buyer and the supplier. A letter of credit is a popular option, offering a guarantee from the buyer’s bank that payment will be made on time and for the correct amount. This arrangement protects both parties and ensures smooth transactions. Payment dates are critical, as they specify when payments should be made to avoid late payments. Consistent adherence to agreed payment dates is vital for maintaining good relationships with suppliers and avoiding financial penalties.

Accounts payable departments manage outgoing payments and often use procurement software to streamline processes, reduce errors like overpayment or double payment, and optimize cash flow. Early payment options may also be available, where buyers pay their invoices before the due date in exchange for discounts. This can be beneficial for both parties: suppliers receive quicker payments, improving their cash flow, while buyers reduce overall costs.

Payment practices poll data can provide insights into industry standards and help companies benchmark their practices against others. Efficient payment practices are essential for cash flow optimization, ensuring that businesses have the liquidity needed to operate smoothly. Addressing and resolving payment disputes promptly is also crucial to maintain strong supplier relationships and avoid disruptions in the supply chain.

Here’s how SpendEdge can help you with its market intelligence solutions

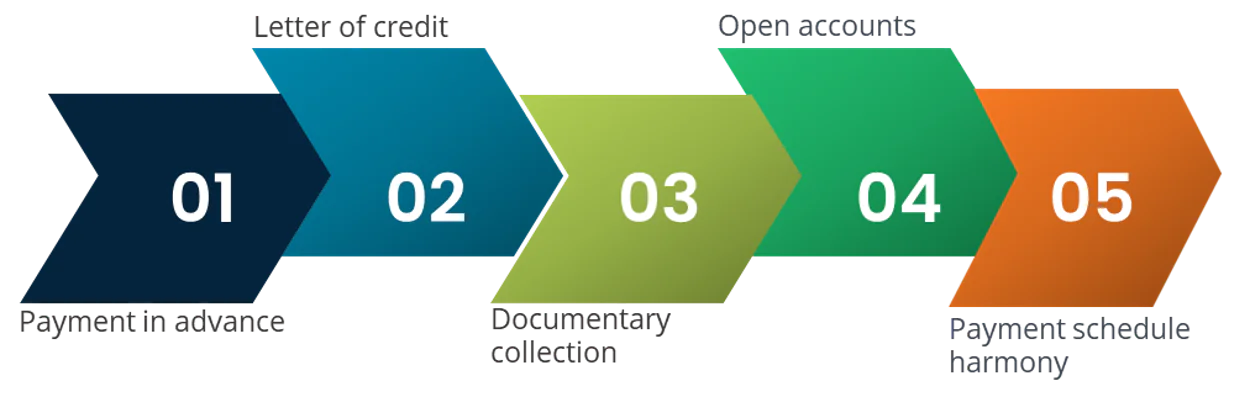

Diverse payment terms: an array of options

Payment in Advance:

Payment in advance is a payment method where the buyer is required to pay for goods or services before they are shipped or delivered. In this arrangement, the seller receives payment upfront, which provides them with the highest level of security. However, this method may not be favorable for buyers as they bear the risk of non-delivery or dissatisfaction with the goods/services. While payment in advance provides sellers with security and cash flow benefits, buyers should carefully consider the risks and implications before agreeing to this payment method. Clear communication, trust, and mutually beneficial terms can help mitigate risks and build a successful business relationship between the parties involved.

Letter of Credit (LC):

A letter of credit (LC) is a financial document issued by a bank or financial institution, on behalf of a buyer (known as the applicant), to guarantee payment to a seller (known as the beneficiary) for goods or services provided. It serves as a form of payment assurance and risk mitigation in international trade transactions, where the buyer and seller may not have established a level of trust or familiarity with each other. A letter of credit is a widely used instrument in international trade finance, providing a secure and reliable method of payment for buyers and sellers engaged in cross-border transactions

Documentary Collection:

Documentary collection, also known as “documentary trade collection” or “cash against documents,” is a payment method used in international trade and procurement. It involves the exchange of documents related to the shipment of goods and payment between the buyer and the seller’s banks. Documentary collection is often used when the buyer and seller have an established relationship and trust each other, but still want to ensure that the payment is made before the buyer takes possession of the goods. It offers a level of security for both parties, as the seller retains control of the goods until payment is received, while the buyer can inspect the documents before making payment.

Open Accounts:

Open account is a payment term in international trade where the buyer receives goods or services from the seller before making payment. In this arrangement, the seller ships the goods or provides the services to the buyer without requiring payment upfront. Instead, the seller invoices the buyer for the agreed-upon amount, and the buyer is expected to make payment within an agreed-upon period, usually after receiving the goods or services. Buyers benefit from enhanced flexibility and convenient payment terms, while sellers enjoy the allure of capturing market share and streamlining their operations. By aligning their interests and priorities, both parties can foster a successful and sustainable business relationship that contributes to their respective growth and success.

Payment Schedule Harmony:

The concept described here emphasizes the significance of a payment schedule in business transactions, highlighting its importance beyond mere dates or numerical values. In essence, a payment schedule transcends its numerical components to symbolize the broader dynamics of business relationships. It embodies the principles of trust, reliability, and collaboration, fostering an environment where parties can work together toward mutual prosperity and sustained success. By honouring their payment commitments and maintaining a synchronized rhythm of transactions, businesses can cultivate resilient partnerships that withstand challenges and contribute to their growth and prosperity.

How to improve payment negotiation?

Improving negotiation about payment requires a combination of strategy, communication skills, and understanding of both your own needs and those of the other party. Here are some specific tips to help you negotiate payment terms effectively:

- Know Your Financial Situation: Understand your own financial position, including cash flow needs, budget constraints, and any financing options available to you. This knowledge will help you determine what payment terms are feasible for your business.

- Research Market Standards: Research industry standards and typical payment terms for similar goods or services. This information will provide you with context and leverage during negotiations.

- Identify Your Priorities: Clarify your priorities and preferences regarding payment terms, such as the desired payment schedule, discounts for early payment, or flexibility in payment methods.

- Understand the Supplier’s Needs: Consider the supplier’s financial needs and constraints. Understanding their perspective can help you tailor your negotiation strategy to find mutually beneficial payment terms.

- Build Rapport and Trust: Establishing a good relationship with the supplier based on trust and mutual respect can make negotiations smoother. Communicate openly and transparently to build trust.

- Offer Incentives: Propose incentives for the supplier to agree to your preferred payment terms, such as offering a larger volume of business, providing referrals, or committing to a long-term partnership.

- Seek Win-Win Solutions: Focus on finding solutions that benefit both parties. Look for creative compromises that address both your needs and the supplier’s needs.

- Be Prepared to Compromise: Be flexible and willing to compromise during negotiations. Consider alternative payment structures or terms that may be acceptable to both parties.

- Document Agreements: Once you reach an agreement on payment terms, make sure to document the terms clearly in a written contract or agreement. This will help prevent misunderstandings or disputes later on.

- Follow Up and Maintain Communication: After reaching an agreement, maintain open communication with the supplier and follow up on payment terms as necessary. Building a strong relationship with the supplier over time can lead to more favorable payment terms in the future.

These strategies are some of the top suggestions that you can incorporate to improve on your negotiation skills when discussing payment terms with suppliers and achieve outcomes that meet the financial needs of your business.

Tips for payment negotiation

- It may be beneficial to politely request the supplier to consider adjusting the payment terms. If this is not possible, it may be prudent to explore other partner suppliers who may offer more flexibility.

- Engage in negotiations with the intention of reaching terms that are mutually advantageous for both your organization and the supplier.

- Communicate to the supplier that you are carefully evaluating options from other suppliers, with the hope of encouraging approval for exceptions to procurement payment terms.

- Prior to entering negotiations, carefully outline what your company is prepared to offer. Additionally, be prepared to discuss counter offers, which may include establishing a p-card payment program.

- It may be appropriate to request an extension of payment dates to 30 or 45 days to assist with managing cash flow.

- Negotiate the possibility of quarterly payments, if necessary.

- Inquire about whether the payment term encompasses complete delivery as opposed to partial delivery of goods.

- Exercise discretion in sending disputed invoices until a supplier issues a credit note.

- If feasible, explore the option of setting up weekly payments within a 14, 21, or 30-day settlement period, and strive to consistently uphold timely payment practices.

Negotiating payment terms does not always yield fruits

Negotiating with every supplier is not feasible. A brief phone call can lead to improved payment terms from a supplier, saving time and effort. It’s important to engage with stakeholders to develop strategies for removing contract terms. The next step involves notifying suppliers of the new policy changes via email or letter for future reference. Some suppliers may reject requests, and companies often experience a low response rate. While optimizing procurement payment terms is valuable, this value diminishes if operations are disrupted. Once identified, send a small spend and communicate the policy changes to the supplier via email or letter, and request that future transactions be based on the new terms. It’s crucial to prepare an escalation plan as some suppliers may reject requests.

How SpendEdge can help with procurement payment terms with best practices?

SpendEdge offers peer best practices benchmarking solutions, comparing a company’s procurement strategies and performance with industry peers. By analyzing key metrics and identifying best practices, clients gain actionable insights to optimize procurement processes, enhance supplier relationships, and drive cost savings. With data-driven recommendations and continuous monitoring, companies can adapt and improve their procurement operations, staying competitive in the market. Maintaining compliance with best practices will help companies present themselves as a dependable, professional company, using this reputation helps increase client loyalty and trust. Enforcing best practices streamlines processes and brings in standardization of operations. Streamlining processes eliminates unnecessary steps, thereby improving efficiency and collaboration.

Start your free trial now to have a demo of our services

Here’s how SpendEdge helped a medical device manufacturing company

Our experts at SpendEdge provided procurement market intelligence solutions recently to a global medical device manufacturing company and helped optimize their payment terms within the life sciences industry. Facing challenges in identifying industry-standard payment terms, the client turned to SpendEdge for guidance.

We initiated a comprehensive analysis, leveraging our extensive network and expertise in the life sciences sector. Through structured primary research with both buyers and suppliers, SpendEdge identified the payment terms practiced by best-in-class procurement organizations within the industry. Armed with valuable insights, the client was equipped to renegotiate payment terms with certain suppliers that deviated from industry norms. By aligning our procurement practices with industry standards, the client not only enhanced their supplier relationships but also achieved significant cost savings. SpendEdge’s tailored approach and in-depth industry knowledge enabled the client to navigate complex procurement challenges effectively.

For more detailed information on procurement payment terms

Conclusion

Effective procurement payment terms are integral to the financial health and operational efficiency of any business. By establishing clear and mutually beneficial payment options with suppliers, companies can optimize their cash flow and maintain strong supplier relationships. Utilizing advanced procurement software and engaging in industry benchmarks, such as the Payment Practices Poll, enables businesses to refine their payment schedule and avoid common pitfalls like overpayment and double payment. Ensuring timely payments and exploring early payment options can further enhance cash flow optimization, supporting a robust procurement process that aligns with the overall strategic goals.