By: Ankur Rishi

Industrial valves find application across sectors, including oil and gas, energy, water treatment, and chemicals. Essentially, these devices serve to start, stop, or modulate the flow of fluids (liquids, semi-liquids, gases) and these come in a range of configurations (such as gate, ball, globe, butterfly, check). Valves could be metal, plastic, or ceramic. Metal valves are increasingly utilized in oil and gas operations, electricity generation, water treatment, chemical facilities, and mining activities. On the other hand, sectors like wastewater treatment, food and beverages manufacturing, pharmaceutical production, as well as paper and textile production processes make use of plastic industrial valves. Ceramic industrial valves are also deployed in several of the previously mentioned sectors. Ideally, an industrial valve distributor stocks valves from multiple manufacturers and, by so doing, ensures end users have access to a vast range of efficient and safe-for-use valve offerings. The number of industrial valve manufacturers, – including small, medium, and large businesses – in the US alone stood at 1,000-plus at last account. By the look of things, distributors are spoiled for choice when it comes to the procurement of industrial valves. However, making the right valve procurement decision without getting distracted by the forest of choices around is no easy task. Only this will ensure high-quality valves of the right quantity, material, and size are within easy reach of the customer at any point in time. Moreover, industrial valves must meet health and environmental protection mandates.

Get ready access to valve procurement know-how

So, talking of industrial valves, what is the process of procurement? Distributors of industrial valves are responsible for providing high-touch support to customers in terms of not just valve selection and deployment but also aftermarket services. The responsibility for making the right choice of industrial valves rests, for the most part, on the super broad shoulders of the distributor. So, distributors would naturally be expected to stay on top of the latest trends in industrial valves. Distributors have a deep understanding of valves and their applications. As previously mentioned, industrial valve selection can be a convoluted process in which a host of parameters need to be factored in. Key procurement criteria for valves include nature of end application, valve type, material, size, and end connections that fit the piping system like a glove., Distributors do the necessary handholding, so much so that customers don’t have to get in a sweat about these and other requirements like cost, order fulfillment time, certifications (CE, API), and the methods of opening or closing the valve disc.

Consistently deliver on promises

Theprocurement process for valves can be quite challenging in the light of requirement changes, incomplete specifications, supply-side disruptions, squeezed budgets, and supplier performance issues. Any procurement process still stuck fast to antiquated sourcing systems is sure to experience efficiency loss, besides risking errors and failures. Failure to comply with quality and safety mandates in the valves procurement process could land sourcing teams in a soup. Meeting environmental, social, and governance (ESG) mandates is equally critical, and the consequences of non-compliance are going to be ruinous. Non-compliant businesses might end up denting their hard-won reputations. Distributors of industrial valves can help by getting employees, owners, shareholders, and suppliers on the same page, thus paving the way for hassle-free project completions.

Wow the customer every single time

Having a resourceful valves distributor is like having an extended arm for your procurement process. Working closely with the customer, the distributor’s teams capture business and technical requirements accurately and then create itemized plans for error-free delivery of goods and services. The distributor’s accountability doesn’t end there. Furthermore, all inventory is tracked across their movement and storage with the objective of ensuring on-time delivery of valves each time and every time.

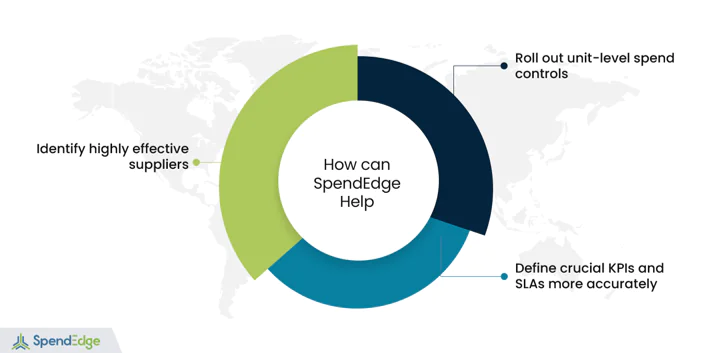

How SpendEdge can help you

Identify highly effective suppliers

At SpendEdge, our experts enable businesses across sectors to make more informed decisions when selecting and onboarding new vendors. To this end, we evaluate vendor competence across multiple parameters, going beyond cost and risk management. The result is that our clients, including in the industrial valves sectors, are able to find supply-side partners matching their distinct business context and work towards shared procurement process goals.

Roll out unit-level spend controls

Our experts strive to get a measure of procurement data at a very granular level, which helps clients rein in their spending more effectively and at a unit level. Our spend management methodology involves collecting, scrubbing, sorting, and cataloguing data and delivering itemized breakdown of spend patterns. This opens whole new opportunities for clients to cut back costs relentlessly, weed out inefficiencies, and make the most effective use of procurement process budgets.

Define crucial KPIs and SLAs more accurately

SpendEdge experts are among the ninjas when it comes to identifying essential supplier key performance indicators (KPIs) and service-level agreements (SLAs). We collaborate with businesses the world over to define performance metrics, which in turn map to specific objectives of the procurement process. With clearly spelt-out performance measures, organizations can gauge supplier performance, including in valves procurement, more accurately, apart from tracking deliverables, and enabling compliance with changing regulatory mandates.

Success story: A one-of-a-kind best-practices benchmarking for a process controls business

Based in southern North America, our client is a provider of process control equipment and regulation systems to oil and gas businesses in the US. The business’s product line includes various accessories and control devices for opening, closing, and regulating fluid transmission. The company was founded in the ‘80s. By the end of the decade, it had earned its place in the production and distribution of tight shut-off butterfly valves, brass ball valves, and tilting disk check valves. To date, these products continue to live up to stringent user expectations.

Rapid development of the oil and gas sector is propelling growth for the client’s industry, and the client ended fiscal year 2022 with $12 million in revenue. However, the appearance of startups in the landscape with bespoke solutions and innovative fail-safe valves is a new development established players in the sector must engage with. The client wants to curb risks on the supply side, save on procurement process costs, and channel the savings into new product development. To start with, the client looked to develop a clear understanding of how its procurement process matches up with its peers within industry and outside of it. Earlier this year, the client engaged our experts in global sourcing to deliver the latest insights on the best practices followed by businesses, no matter what industry, with a highly effective procurement process.

In response to the client’s requirements, our specialists carried out an extensive benchmarking analysis of competitor firms, and, in the main, we considered sectors like automotive, pharma, CPG, and industrial process controls, including industrial valves. The point of origin of our research was the core purpose of the purchase function at best-of-breed organizations in various sectors. We gathered considerable data on the way work “flows” through the procurement process and the functions these teams perform in order to achieve the desired procurement goals. Their annual purchase budgets, purchase volumes, efficiency, and differing engagement models also formed part of the study. The report shed ample light on the key metrics frontrunning procurement organizations bring into play to realize the most value in the procurement process. At the same time, they succeed in reducing wastage of scarce resources (materials, time, energy). These metrics include total cost savings, cost avoidance, procurement process cycle time, and the percentage of suppliers who account for the lion’s share of the procurement spend. That’s not all. We also weighed up other parameters like returns on procurement dollars and spend under management as a share of total spend. We also captured the latest developments in the procurement process as well as how peer organizations are faring, and this was, in fact, the pièce de resistance of the study. Our research is helping the client develop a better and high-level understanding of the red-hot practices in procurement and the best financial metrics and KPIs in sourcing. Going forward, the client’s mid-to-long-term procurement plans, which includes industrial valves procurement, will likely be informed by the data that came out of this study.

Contact us now to solve your procurement problems!

Author’s Details

Ankur Rishi

Vice President, Sourcing and Procurement Intelligence

With more than 12 years of advisory experience, Ankur manages platform content and services within the sourcing and procurement vertical. Over the years, Ankur has provided consulting services to category leaders from chemicals, energy, and packaging industry, on varied topics, such as category strategy, spend analysis, commodity pricing, and clean-sheet analysis.