By: Manpreet Kaur

The oil and gas industry supply chain involves a complex network of activities, including exploration, drilling, production, transportation, refining, and distribution. It encompasses various stakeholders, from oilfield service companies to refineries and distributors, working together to extract, process, and deliver to consumers and industries worldwide. In the oil and gas industry, procurement encompasses a wide range of goods and services, including pumps, drilling rigs, raw materials such as steel, steel alloys, copper etc. Procurement in the oil and gas industry plays a critical role in sourcing, acquiring, and managing the necessary materials, equipment, and services for exploration, production, and refining operations. This involves negotiating contracts, ensuring supply chain efficiency, managing supplier relationships, and optimizing costs. Effective procurement is essential for maintaining operational continuity and maximizing profitability in this capital-intensive sector.

Challenges faced by oil and gas procurement teams while acquiring inputs

Fluctuation in the prices:

The oil and gas industry is exceptionally susceptible to abrupt shifts in commodity prices. Unexpected declines in oil prices can result in decreased exploration and production endeavors, ultimately impacting the entirety of the supply chain. Effectively balancing expenses and ensuring profitability within this volatile market remains an ongoing and formidable task for industry stakeholders. This challenge underscores the industry’s need for proactive cost management strategies and risk mitigation measures to navigate its inherent unpredictability.

The advent of globalization and the complexity associated with its emergence:

The oil and gas supply chain is expansive and intricate, encompassing exploration, drilling, production, transport, refining, and global distribution. Effectively overseeing this multifaceted network, often spanning numerous countries and regulatory landscapes, presents substantial difficulties. Supply chain interruptions stemming from geopolitical tensions, regulatory alterations, or natural calamities can exert profound and cascading impacts, underscoring the imperative of resilient supply chain management in the industry. In addition to its geographical and regulatory complexity, the oil and gas supply chain also grapples with intricate logistics, rigorous safety standards, and environmental sustainability concerns.

Environmental and regulatory compliance:

Alarming environmental awareness and increasingly stringent regulations present substantial hurdles for the oil and gas supply chain. Adherence to emissions controls, safety protocols, and environmental safeguards introduces intricate intricacies and financial burdens. Firms are compelled to commit to technological advancements and operational enhancements aimed at curbing their ecological impact, all while steering through ever-evolving regulatory frameworks. Balancing sustainability and profitability becomes a pivotal task in this dynamic industry landscape, prompting ongoing innovation and adaptation.

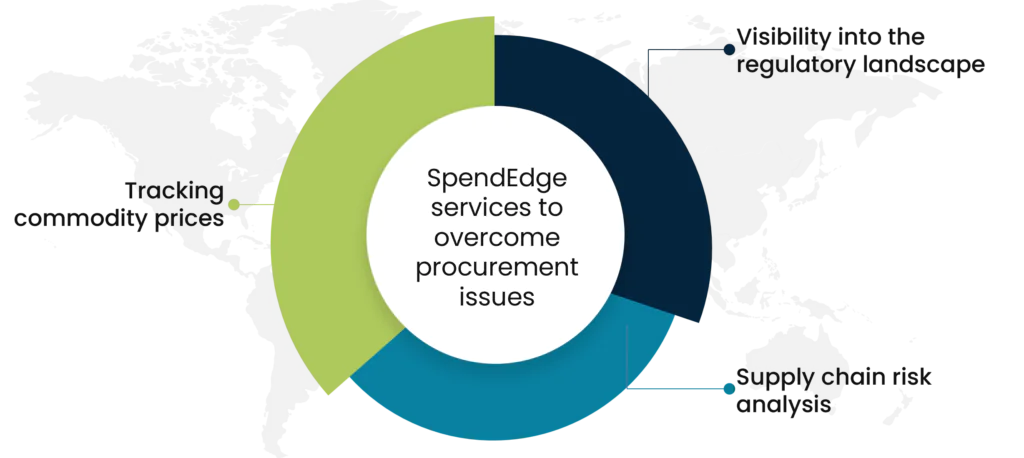

SpendEdge services to overcome procurement issues

Tracking commodity prices:

Our expertise can help you monitor price changes for fuel, steel, metals, raw materials, pumps, and other commodities that are procured. We provide accurate pricing insights for you to make appropriate cost-sensitive procurement decisions. We provide oil companies with information about historical price trends for each commodity essential to their business. We ensure that your predictions are accurate by providing both univariate and multivariate models. Achieve significant cost savings by employing our price-hedging as a risk mitigation tool.

Supply chain risk analysis:

Our team can help you analyze and manage supply chain risks. We conduct risk analysis studies to identify major risks associated with the overall supply chain and provide recommendations on risk mitigation strategies. We perform supplier risk analysis to evaluate existing and potential risks associated with each supplier and take corrective action to strengthen overall supplier relationship management. We keep up-to-date with the latest developments related to risk management tools, which can help you reinforce supply chain resilience.

Visibility into the regulatory landscape:

We can assess the overall regulatory landscape and provide visibility into the structure of regulations imposed in different geographic locations and also for different commodities that are procured. We provide you with information about the latest regulatory changes and environmental social governance (ESG) trends to ensure compliance across all tiers of the supply chain. We identify modern sustainability practices adopted globally and in geographies specific to your company’s operations. By leveraging our comprehensive insights, companies can enhance efficiency, reduce costs, and achieve sustainable and compliant operations throughout their supply chains.

The success story of how SpendEdge was helpful to one of its oil industry clients

A leading US based company with operations in over 30+ countries across the globe was looking for a partner who could support in conducting a detailed procurement organization benchmarking analysis.

The client wanted to gain visibility on the best practices that are followed by other successful procurement organizations across various industries.

To support the client requirements, we conducted a deep-dive benchmarking analysis with focus on industries such as Automotive, Pharma, CPG etc. In this study we first identified the overall mission of the purchasing department across best-in-class procurement organizations and gathered insights on the structure of organizations’ purchasing departments and their overall scope/responsibilities. We also assessed their annual purchase spend, volume, efficiency, and engagement models. This report provided detailed visibility on key parameters/metrics that are used by companies to measure procurement efficiency such as total cost savings, cost avoidance, implemented cost reduction savings, procurement cycle time, % of suppliers accounting for 80% of the spend, procurement ROI, managed spend as a % of total spend etc. We also captured emerging procurement trends and peer analysis in this study.

This study helped the client get better visibility on the emerging procurement best practices, commonly observed KPIs and procurement trends. We also provided detailed comparison of different procurement organizations covering their geographic presence, their structure and overall procurement strategy.

.

Contact us now to solve your procurement problems!

Author’s Details

Manpreet Kaur

Assistant Manager Presales – Sourcing and Procurement Intelligence

Manpreet is a presales specialist at Infiniti Research and has expertise in sales, business strategy execution, and innovative solution design. She is actively involved in supporting clients from F&B, CPG, Healthcare, Pharma, Chemicals, BFSI, Oil & Gas and Automotive sectors.