Most common terminologies, but often mistaken

When it comes to procurement and category management, one would often use terminologies such as RFI, RFQ, and RFP. Despite sounding similar, each of these terms has a distinct meaning and implication on procurement strategy. Understanding these differences is crucial for organizations to make informed procurement decisions and achieve better outcomes.

What is RFI (Request for Information)?

An RFI (Request for Information) usually is the first step in the procurement process when procurement teams considering sourcing of a product or service would run to obtain critical information on the suppliers. This is done to develop a top level understanding of parameters such as business overview of suppliers, offerings, business process, key personnel, geographic coverage etc., Procurement issues an RFI (Request for Information) with a motive of developing a long-list of potential suppliers and to gain clarity on their capabilities at a top level.

Typical scope of an RFI (Request for Information):

- Primary purpose: Gathering general information about products, goods and services offered by vendors.

- Content and scope: Broad and exploratory, asking for general information about vendor capabilities, experience, and potential approaches to addressing a need or problem.

- When to use: Uncertain about specific project requirements, identifying new and innovative vendors, or need a high-level understanding of a supplier’s capabilities in alignment with procurement strategy.

- Vendor response: Provides broad information about the vendors’ services, products, and capabilities without specific pricing or project plans.

- Outcome: Helps in shortlisting potential vendors for future RFQs or RFPs based on their capabilities and alignment with business needs.

What does RFQ (Request for Quotation) mean?

An RFQ (Request for Quotation) is a more formal request as compared to an RFI (Request for Information) with a motive of obtaining pricing information from potential or shortlisted suppliers. Procurement teams run RFQs when they have already shortlisted a few vendors and have a clear understanding of the requirements and are looking for competitive pricing from suppliers.

Typical scope of an RFQ (Request for Quotation):

- Primary purpose: Obtaining pricing information for specific products or goods and services.

- Content and scope: Clearly defines the products or services required in alignment with procurement strategy, quantities, delivery timeframe, terms and conditions, quality certifications, and other specific requirements.

- When to use: Situations where the requirements are clear-cut, and the main deciding factor is price.

- Vendor response: Primarily focused on price quotes for the requested products or services.

- Outcome: Choosing a vendor based on the best price and conducting further negotiations where required.

What is RFP (Request for Proposal)?

The RFP (Request for Proposal) is the most comprehensive and detailed of the three. Procurement teams run an RFP when they have complex requirements and are looking for detailed proposals or solutions to meet their exact expectations. An RFP is expected to provide solutions or approaches to meet specific business needs, leading to a detailed assessment of capabilities of the vendors and eventually selecting one or more best-fit vendors.

Typical scope of an RFP (Request for Proposal):

- Primary purpose: Requesting detailed solutions or proposals that is tailored to the needs of the requestor, with a request for an elaborate plan from vendors on how they would meet the specifications to support the procurement strategy.

- Content and scope: Typically much detailed than RFIs and RFQs and incorporates elements such as how they fit the expectations, what is the delivery plan, approach, credentials, price competitiveness etc.,

- When to use: Complex or strategic spend categories where the solution approach, vendor capabilities, and creativity are as important as cost.

- Vendor response: Comprehensive proposals detailing how the vendor plans to meet the requirements, their credentials, certifications, a clear approach, and a breakdown of costs.

- Outcome: Selecting a vendor based on a combination of factors, including solution fit, expertise, and cost.

Importance of the Service

Category Specific Customization is Key

Sometimes the RFIs, RFQs and RFPs tend to be generic and templatized, not catering to precise needs of the business stakeholders. So, spending some thought and effort into drafting these RFIs, RFQs and RFPs would lead to better results. It is advisable to involve business stakeholders while developing these documents to ensure there is enough detailing of business needs. Multiple reviews of the questions asked, parameters for selection, pricing templates, documents requested etc., would help in developing a concrete wish list. Also, proactive involvement of business stakeholders such as category managers and buyers in Q&As with the vendors could improve the quality of responses from the vendors and help in selecting the best vendors.

Low Response Rate From Vendors Could Hamper the Overall Selection Process

RFIs and RFPs that are perceived to be vague, burdensome or too complex might receive less responses as the vendors might not be too keen to invest time and resources in responding. Similarly, poorly designed RFPs that lack clarity and relevant questions can result in poor responses. All of these lead to one clear challenge – missing out on bids and interest from potential best-fit vendors. Imaging a few good vendors deciding not to participate in the event, procurement would be left with a few options from average suppliers and would be forced to settle with one of them. So, putting good effort into developing clear, concise and easy to fill in RFIs, RFPs and RFQs is vital for best results.

Lack of Prequalification

Including unqualified vendors through poor supplier due-diligence can result in poor outcomes as chances of finding the best-fit suppliers would reduce. Taking a step-by-step approach in developing a long-list of vendors, assessing their capabilities, position in the marketplace and shortlisting the top potential vendors is a critical step. This will ensure that the right set of vendors are invited to the events and their participation would yield good options to consider. Involving the end-stakeholders at an earlier stage would be more productive as they can validate the list of suppliers and include critical suppliers that are missing, if any. Also, providing timely responses to vendor questions would encourage their participation and bring in better involvement during the due-diligence process.

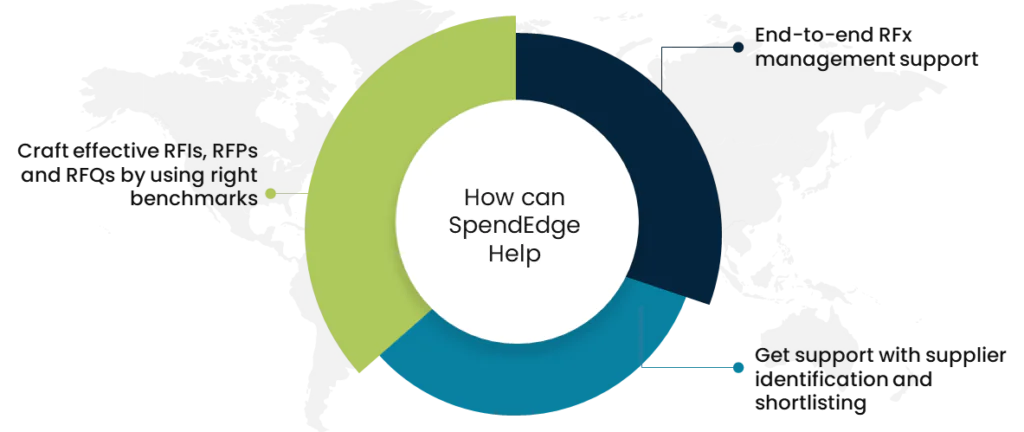

How SpendEdge can help you?

Craft effective RFIs, RFPs and RFQs by using right benchmarks

Our SpendEdge reports come with a dedicated section on RFx essentials which include curated questions that can be included as a part of RFIs, RFQs and RFPs. These are unique set of questions for each stage tailored for 950+ direct and indirect spend categories and sub-categories. These are developed based on interactions with industry leaders and experts of individual categories. The idea is to provide users with a pre-made list of credible questions that can be directly used to start building questionnaires without having to conduct a research from scratch.

End-to-end RFx management support

In addition, SpendEdge also offers RFx event management support where our experts extend support with crafting RFIs, RFPs and RFQs tailored to the category of interest and run end-to-end events. Our experts would work closely with the category managers or buyers to define the requirements clearly, narrow down on supplier selection criteria, selection process define the questions clearly, shortlist and invite the best-fit-vendors, do follow-ups with them to complete the questionnaires, maintain adherence of vendors to timelines, respond to their questions on time and analyze the received information.

Get support with supplier identification and due–diligence

SpendEdge specializes in helping clients build a list of suppliers based on systematic assessment of their capabilities and position in the marketplace. Our team takes a robust approach in preparing a long-list of suppliers, assessment of their operational and functional capabilities, shortlisting the suppliers based on their capabilities, developing deep-dive profiles including financial details and risk assessment, mapping suppliers on a supplier positioning matrix and visualize the top vendors, contenders and niche vendors. This exercise ensures vetting of vendors in a timely manner and inclusion of all critical vendors for best outcomes of RFIs, RFPs and RFQs.

Success Story: A leading US based BFSI firm identifies best strategic partner through a successful RFP process

Headquartered in the US and with niche presence in North America, Europe, Asia, Africa, and the Middle East, our client provides a full spectrum of services in banking and insurance to individuals and businesses. The client’s assets totaled $30 billion in the 2022 fiscal year. Digital transformation through engagement with most innovative vendors is high on our client’s agenda. Over the last decade, the client’s revenue growth has exceeded guidance. However, it has quite a few challenges to face off, such as the need to adapt latest technologies and become more digital savvy to provide better customer experience and stay ahead of competition.

The client has been working with a few vendors helping in digital transformation, but they have been following traditional methods and were slow in adapting latest technologies such as AI and ML. So, SpendEdge recommended them to go to the market with an RFP (Request for Proposal) to invite the most innovative players in the market and evaluate their offerings through a robust selection process. Our team did a detailed supplier assessment to identify and build a list of most innovative suppliers in the market, their credibility in the BFSI space, current clientele, strength in AI, ML and other advanced technologies, financial details, stability etc.,

Post the supplier identification process, our team also helped the client with crafting of RFI (Request for Information) questionnaire which helped in assessment of broader capabilities of top potential vendors. Post this stage we helped with running an RFP (Request for Proposal) involving the shortlisted vendors. In this stage, the team developed a detailed questionnaire which probed the vendors about their capabilities, plan for implementation, success stories and pricing. By thoroughly analyzing the responses, SpendEdge was able to shortlist. The top 2 vendors and support the client with negotiation levers as well and help them get a good deal.

Author Details:

Srinivas R

Associate Vice President