Introduction

China’s pharmaceutical market is the world’s second largest, valued at over US$332 billion and growing rapidly at a projected CAGR of 7% from 2022 to 2025. This growth is driven by an aging population, rising healthcare spending, and government support for the industry. China has a large patient population with significant unmet clinical needs, especially in oncology and rare diseases. Introducing innovative new drugs can help address these gaps and improve patient outcomes. To encourage innovation, the Chinese government has implemented reforms to streamline the new drug approval process, reducing median approval times from over 3 years to 15 months. Successful new product launches are crucial for companies to capitalize on these regulatory improvements and the ability to align with government priorities.

The innovation and launch of new drugs in China are reshaping both the local market and the global pharmaceutical landscape. For China, this translates to enhanced healthcare, robust economic growth, and a fortified domestic industry. Globally, it fosters increased competition, collaborative opportunities, and significant advancements in public health. The synergy between China’s pharmaceutical innovation and the global industry is driving the future of healthcare, promoting progress, and improving patient outcomes worldwide.

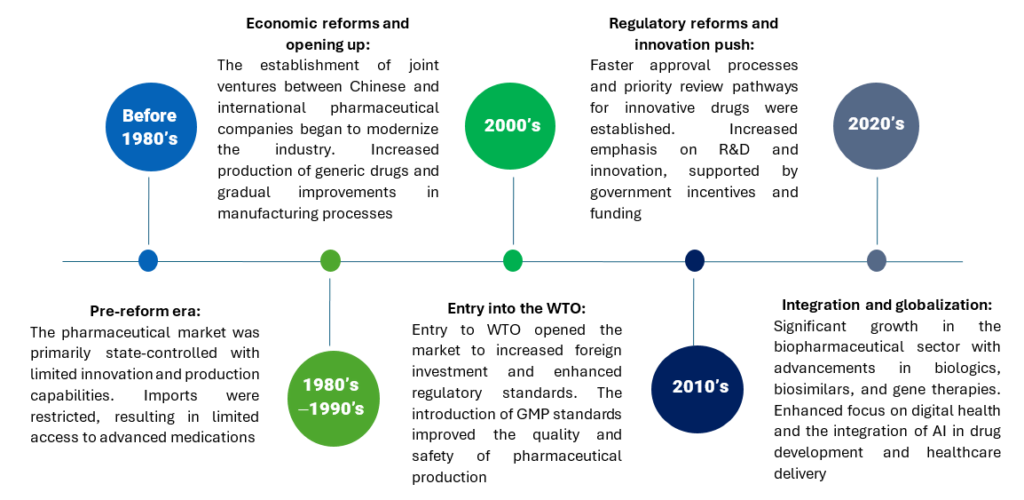

Evolution of China’s pharmaceutical market

China’s pharmaceutical market has evolved from a state-controlled, limited-production industry to a dynamic, innovation-driven market with significant global influence. This transformation is marked by strategic regulatory reforms, increased foreign investment, and a robust push for innovation.

Key milestones and regulatory changes

Some of the key milestones and regulatory changes initiated by the Chinese government are as follows:

| Year | Key milestones and regulatory changes |

| 1992 | New Drug Administration Law introduced, was regarded as the first comprehensive law regulating the production, distribution, and sale of drugs in China. It established the foundation for modern drug regulatory practices. |

| 2001 | China’s accession to the World Trade Organization (WTO) marked a significant milestone, as it opened the market to increased foreign investment and competition. |

| 2007 | The establishment of the State Food and Drug Administration (SFDA), which was later renamed as China FDA (CFDA), became the main regulatory body overseeing drug approval, quality control, and safety standards. |

| 2007 | Implementation of Good Manufacturing Practices (GMP) to enhance production quality and safety of pharmaceutical production. |

| 2014 | Implemented the Medical Device Clinical Trial Regulation (MDCTR) to regulate the requirements for conducting clinical trials of medical devices, aiming to ensure the safety, efficacy, and quality of medical devices through standardized clinical evaluation processes. |

| 2016 | The Marketing Authorization Holder (MAH) system was introduced. This system allowed entities other than manufacturers to hold drug approvals, facilitating more flexibility in drug development and commercialization. |

| 2017 | By joining the International Council for Harmonisation (ICH), it committed to adopting international standards for drug quality, safety, and efficacy. It provided enhancements in clinical trial regulations and data standards. |

| 2018 | Renaming and restructuring of CFDA to National Medical Products Administration (NMPA) reflected a broader regulatory scope. It continued focus on improving drug approval efficiency and safety monitoring. |

| 2019 | Comprehensive update done to the Drug Administration Law to enhance regulatory oversight. It mainly emphasized on innovation, quality control, and severe penalties for non-compliance. |

| 2020 | Implementation of the Patent Linkage System, which links drug patents to regulatory approvals, aimed at protecting intellectual property and encouraging innovation. |

| 2020 | Introduction of the Priority Review and Conditional Approval Mechanisms to expedite the approval of urgently needed drugs and innovative therapies. |

| 2021 | Establishment of the China National Innovation Drug Development Plan to boost R&D and support the development of innovative drugs. It focused on providing funding and policy support for biopharmaceuticals and cutting-edge therapies. |

| 2022 | Regulatory frameworks to support the safe and effective use of digital health solutions. It aims for integration of digital health technologies, including AI, in drug development and healthcare delivery |

These milestones and regulatory changes reflect China’s commitment to transforming its pharmaceutical industry into a globally competitive, innovation-driven sector, enhancing healthcare outcomes domestically and internationally.

The reforms in the Chinese drug regulatory system have significantly impacted the new drug approval process, reducing the median New Drug Application (NDA) approval time to 15.4 months between 2017 and 2021, the shortest approval time in the past decade. Previously, the NDA approval time in China was 22.1 months from 2011 to 2013 and 35.1 months from 2014 to 2016.

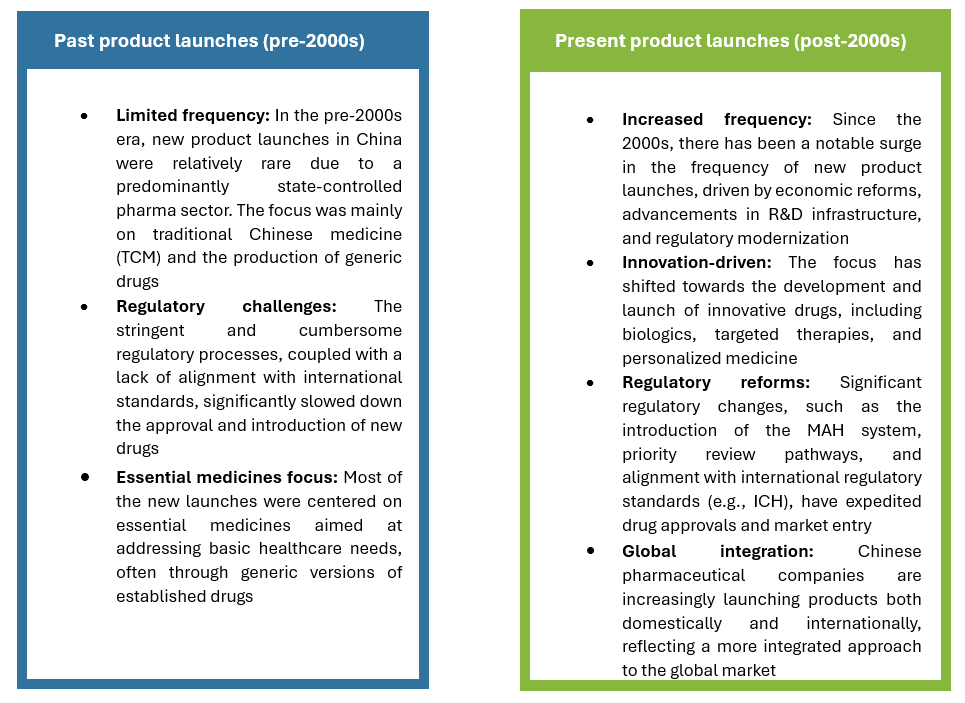

Past trends in product launches

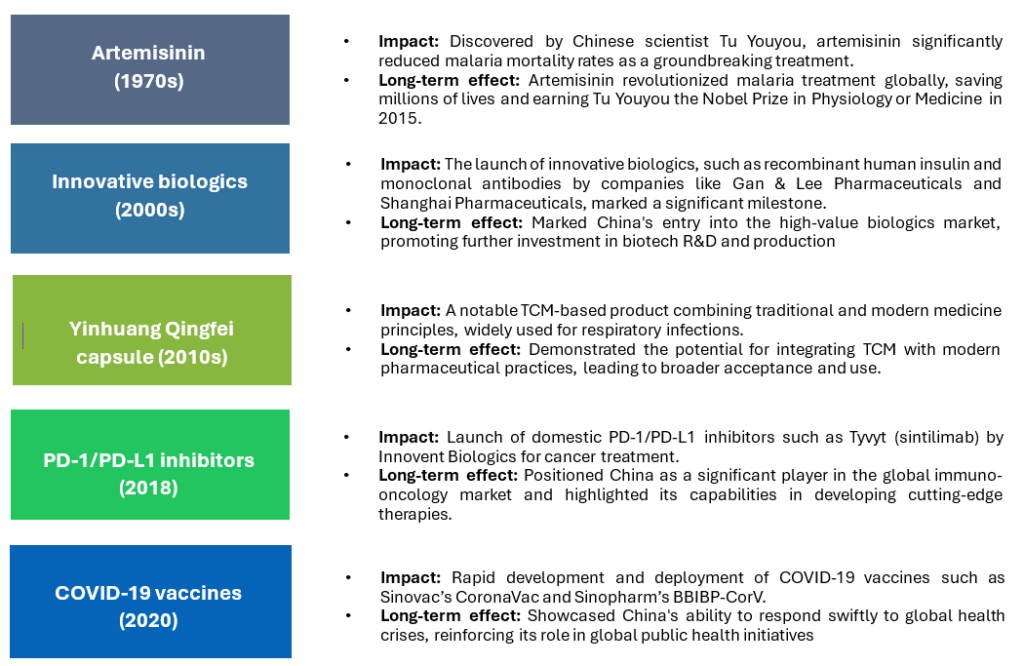

The landscape of product launches in China’s pharmaceutical market has undergone a dramatic transformation. Historically, the industry was characterized by a focus on generics and essential medicines, with limited new product introductions due to regulatory and infrastructural challenges. However, significant reforms and substantial investments in research and development over the past two decades have led to a marked increase in the rate of new product launches. The focus has shifted towards innovative therapies and biologics, positioning China as a key player in the global pharmaceutical industry. Notable product launches, such as artemisinin for malaria and PD-1 inhibitors for cancer, have had profound impacts, not only domestically but also globally, cementing China’s status as a leader in pharmaceutical innovation and production.

Comparison of past and present product launches

Did you know? In 2023, the China NMPA approved a total of 191 NDAs. This total includes chemical drugs, therapeutic biological products, and traditional Chinese medicines (TCMs), and excludes vaccines and diagnostic reagents.

For instance, in May 2023 alone, China NMPA approved 27 new drugs, among which 16 are chemical drugs while 11 are biological products:

| S. No. | Company name | Drug name |

| 1 | Betta Pharmaceuticals | Befotertinib mesylate capsules |

| 2 | Sanhome Pharmaceutical | Alfosbuvir tablets |

| 3 | Novartis | Ribociclib succinate tablets |

| 4 | Boehringer Ingelheim | Empagliflozin tablets |

| 5 | Eisai | Perampanel oral suspension |

| 6 | Mirum Pharmaceuticals | Maralixibat chloride oral solution |

| 7 | ViiV Healthcare | Dolutegravir sodium dispersible tablets |

| 8 | Amgen | Etelcalcetide hydrochloride injection |

| 9 | Otsuka | Aripiprazole for injection |

| 10 | Bayer | Copanlisib hydrochloride for injection |

| 11 | Amarin | Icosapent ethyl soft capsules |

| 12 | Livzon | Triptorelin acetate microspheres for injection |

| 13 | Bayer | Finerenone tablets |

| 14 | Hangzhou Shanghe | Terbutaline sulfate oral solution |

| 15 | Nanjing Zenkom | Dexketoprofen trometamol injection |

| 16 | Hanmi Pharm | Dexibuprofen suspension |

| 17 | AB&B Bio-tech | Quadrivalent subunit influenza vaccine |

| 18 | Yifan Pharmaceutical | Efbemalenograstim alfa injection |

| 19 | Wolwo Pharma | Skin prick solution for Humulus japonicus pollen allergens |

| 20 | Wolwo Pharma | Skin prick solution for Artemisia annua pollen allergens |

| 21 | Wolwo Pharma | Skin prick solution for Betula platyphylla Suk. pollen allergens |

| 22 | BioRay Biopharmaceutical | Zuberitamab injection |

| 23 | BeiGene | Tislelizumab injection |

| 24 | Innovent | Bevacizumab injection |

| 25 | Innovent | Sintilimab injection |

| 26 | Janssen-Cilag | Daratumumab injection (subcutaneous injection) |

| 27 | Sun Pharmaceutical | Tildrakizumab injection |

Notable past launches and their impacts

The shift toward innovation

The transformation of China’s biopharmaceutical ecosystem towards innovation is evident in the surge of market value, the growth in biologics, and the increased share in the global innovation pipeline. These changes are set to bring significant benefits to patients through the development of new and more effective treatments, while also positioning China as a key player in the global biopharmaceutical industry.

Surge in market value

The market value of publicly listed biopharma innovation players and biotechnology companies originating in China has skyrocketed in the last ten years. The remarkable surge in the market value of China’s biopharma innovation players is a testament to the sector’s dynamic growth and transformation. Through increased investment, advancements in R&D, regulatory reforms, a growing domestic market, and global expansion, Chinese biopharma companies have positioned themselves as influential players in the global biopharmaceutical landscape.

Several factors have contributed to this dramatic increase in market value:

- Increased Investment and funding: Chinese biopharma companies have attracted substantial investment from both domestic and international sources, supported by significant government funding and innovation-friendly policies. This has enabled expanded research and development, leading to new therapies and technologies

- Advancements in R&D: The Chinese biopharmaceutical industry has made significant R&D advancements, with companies establishing state-of-the-art research facilities and forming strategic partnerships with global pharmaceutical companies and academic institutions. These collaborations have accelerated the development of innovative drugs and treatments

- Regulatory reforms: China has implemented regulatory reforms to streamline the drug approval process and encourage innovation. The NMPA has introduced policies to expedite new drug reviews and approvals, reducing time to market and making drug development more attractive

- Growing domestic market: Driven by an aging population and increasing chronic disease prevalence, China’s domestic biopharmaceutical market has grown significantly. This demand for advanced medical treatments has spurred Chinese companies to develop innovative drugs to meet local needs

- Global expansion: Chinese biopharma companies have expanded globally by acquiring foreign companies, forming joint ventures, and establishing overseas research centers. This expansion has increased their market value and enhanced their reputation as leading players in the biopharmaceutical industry.

Several Chinese biopharma companies have emerged as leaders in the industry, contributing to the overall market value surge. Companies like Jiangsu Hengrui Medicine, BeiGene, and Innovent Biologics have made significant strides in developing innovative treatments and have gained recognition on the global stage. Their success stories serve as examples of the potential and capabilities of Chinese biopharma firms.

Biologics growth

Biologics include a wide range of products such as vaccines, blood components, gene therapies, tissues, and recombinant proteins. The complexity and potential of biologics have driven Chinese companies to invest heavily in this area, contributing to their overall innovation capabilities. Through increased investment, advancements in research, regulatory support, and strategic collaborations, China has emerged as a global leader in the development and production of biologics, offering new hope for patients worldwide.

Several factors have contributed to the biologics growth in China:

- Increased investment in biologics: The Chinese government has provided significant funding, grants, tax incentives, and subsidies for biologics, encouraging private investment from venture capitalists and biotech funds

- Advancements in biologics research: Chinese researchers have developed cutting-edge technologies and methodologies for production and analysis, including improvements in cell culture techniques, bioprocessing, and biomanufacturing.

- Vaccine development: China has become a global leader in vaccine development, especially with COVID-19 vaccines from companies like Sinopharm and Sinovac, bolstering its reputation and encouraging further investment.

- Gene therapies and precision medicine: Companies like BeiGene and Legend Biotech are at the forefront of developing advanced gene therapies for cancer and genetic diseases, focusing on personalized treatments based on genetic profiles.

- Biosimilars: Chinese companies are producing biosimilars to offer affordable alternatives to expensive biologics, increasing access to medications and driving market competition and innovation.

- Infrastructure and manufacturing capabilities: China has invested in state-of-the-art biopharmaceutical manufacturing facilities that meet international standards, attracting global collaborations.

- Regulatory support: The NMPA has reformed regulations to support biologics development, including faster review processes and pathways for complex biologics, reducing barriers and accelerating time-to-market.

- Collaborations and partnerships: Strategic partnerships with global pharmaceutical giants and research institutions have facilitated knowledge exchange, technology transfer, and co-development, accelerating biologics research and development in China.

Several innovative biologics products developed by Chinese companies have gained international recognition. For example, Innovent Biologics’ PD-1 inhibitor, Tyvyt (sintilimab), has shown promising results in cancer treatment. Similarly, Jiangsu Hengrui Medicine has developed innovative biologics for oncology and autoimmune diseases. These success stories underscore China’s growing prowess in biologics innovation.

Global innovation pipeline

The substantial growth of China’s share in the global innovation pipeline is a testament to the country’s commitment to advancing biopharmaceutical research and development. Through increased investment, regulatory support, strategic collaborations, and a focus on unmet medical needs, Chinese companies are making significant contributions to the discovery and development of novel therapies. Chinese companies have been expanding their R&D efforts, leading to the discovery and development of novel therapies. This increase in innovative output highlights China’s growing role in the global biopharmaceutical landscape.

Factors contributing to China’s growing innovation pipeline:

- Increased R&D investment: Chinese biopharmaceutical companies have significantly increased their investment in R&D, with private and public sectors pouring resources into new facilities, talent, and cutting-edge technologies. This has resulted in a robust pipeline of new drugs and therapies

- Focus on unmet medical needs: Chinese firms increasingly target diseases with limited or no effective treatments, such as cancers, rare genetic disorders, and chronic conditions. This focus on unmet medical needs positions China as a leader in global healthcare innovation

- Strategic collaborations and partnerships: Collaborations with global pharmaceutical companies, academia, and research organizations have been pivotal in boosting China’s innovation pipeline. These partnerships facilitate the exchange of knowledge, technology, and expertise, accelerating new therapy development

- Regulatory reforms: The Chinese government has implemented regulatory reforms to support drug innovation, including expedited approval processes for new drugs addressing critical needs. These reforms have reduced time and costs, encouraging more innovation in the industry

- Talent development: China has made concerted efforts to develop a skilled workforce in biopharmaceuticals, through training programs, educational initiatives, and incentives to attract top researchers globally. This has enhanced China’s drug discovery and development capabilities.

Legend Biotech’s CAR-T therapy, ciltacabtagene autoleucel (cilta-cel), shows promise in treating multiple myeloma, highlighting China’s advancements in personalized cancer treatment. Qihan Biotech uses CRISPR to create gene-edited pigs for xenotransplantation, addressing the global organ shortage. Akeso Biopharma’s bispecific antibody, AK104, demonstrates success in treating cancers. These innovations illustrate China’s growing share in the global innovation pipeline.

Factors driving innovation

Key factors contribute to China’s emergence as an innovation hub:

Challenges and barriers

Key challenges and barriers facing China’s biopharmaceutical industry as it shifts toward innovation:

Implications for the global pharmaceutical industry

The factors that underscore China’s evolving role in the global pharmaceutical landscape are shaping market dynamics, fostering international collaborations, and offering diverse investment prospects amidst regulatory and operational complexities:

- Global market dynamics: China’s growing prominence in pharmaceutical manufacturing and innovation significantly influences global supply dynamics. As a major producer of active pharmaceutical ingredients (APIs) and finished drugs, developments in China impact global supply chains, affecting the availability and pricing of medicines worldwide. The scale and efficiency of China’s pharmaceutical industry can lead to lower production costs, potentially exerting competitive pricing pressures globally. This can enhance accessibility to essential medications while posing challenges to profit margins for international firms

- Collaborations and partnerships: International collaborations in R&D between Chinese and global pharmaceutical firms and academic institutions accelerate innovation by pooling complementary strengths and resources to advance new therapies and technologies. Strategic alliances and joint ventures between Chinese companies and multinational pharmaceutical giants facilitate technology transfer and market access, fostering shared risk and investment in high-impact ventures that enhance global competitiveness

- Investment opportunities: China’s expanding biopharmaceutical sector presents compelling investment opportunities. Favorable regulatory reforms, growing market demand, and supportive government policies attract foreign investment. Access to a large patient population for clinical trials and market expansion further enhances China’s appeal. Investing in China’s pharmaceutical sector offers significant returns from market growth and innovation, alongside risks including regulatory uncertainties, IP challenges, and market competition. Strategic partnerships and local insights mitigate risks while maximizing investment potential.

Future outlook

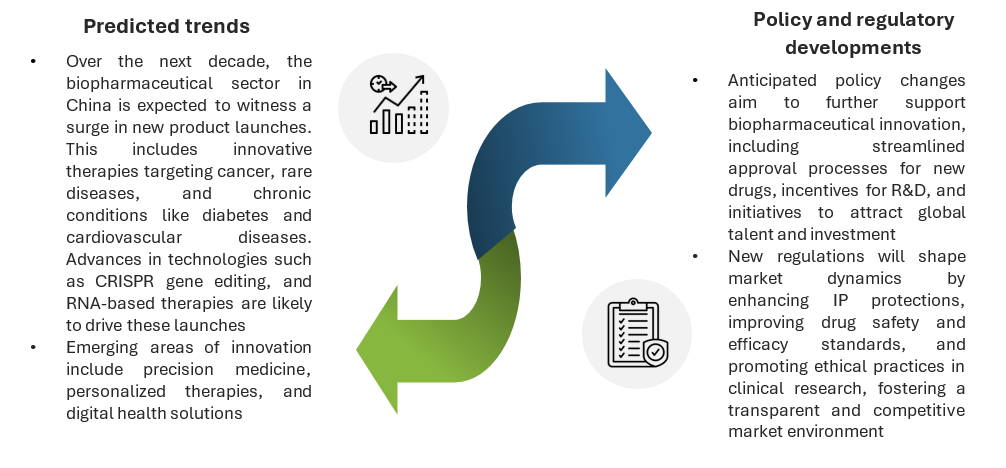

As China continues to emerge as a global powerhouse in biopharmaceutical innovation, several key factors are shaping its trajectory. Predicted trends in new product launches and emerging areas of research, along with anticipated policy and regulatory developments, will influence market dynamics and foster a robust and ethical biopharmaceutical ecosystem in the coming years.