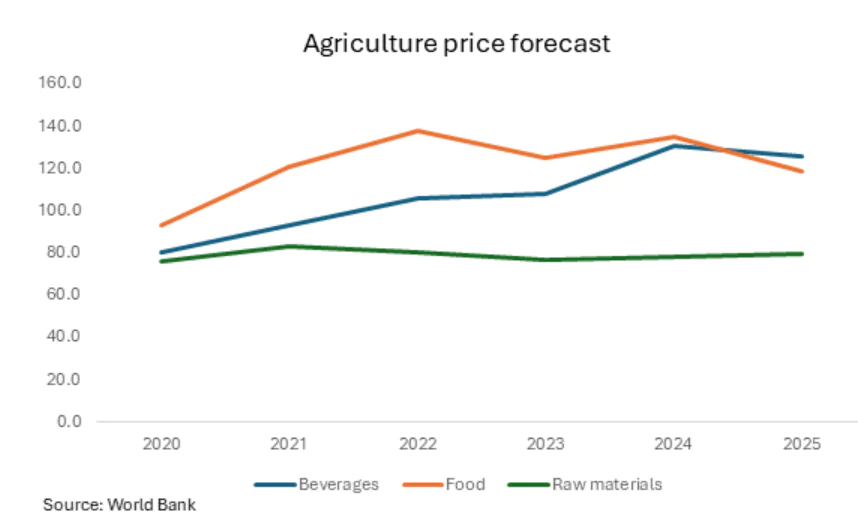

In Q2 2024, commodity prices eased compared to the previous year, as weak global demand exerted pressure on energy costs and the probability of a sufficient crop supply restrained the rise of agro-commodities prices. However, continued geopolitical tensions such as the Israel-Hamas conflict and the conflict between Israel and Iran have provoked volatility in the oil market and increased the price of gold, while increasing supply uncertainties fueled a copper price surge. In 2024, global commodity prices are anticipated to trend downward compared to 2023, though geopolitical concerns and unfavorable weather related to El Niño and La Niña will impact commodity prices.

Ample grain harvesting driving down Agro commodities prices:

Decline In Agro Commodity Prices Amid Volatility Driven by Cocoa Price Surge

Since May 2024, primary crops such as corn, wheat, and soybeans prices started to decline after reaching a record high in April 2024. So far, the prices for wheat and maize have already fallen on the order of 30% year-to-date, thanks to strong production in the US, Argentina, and China.

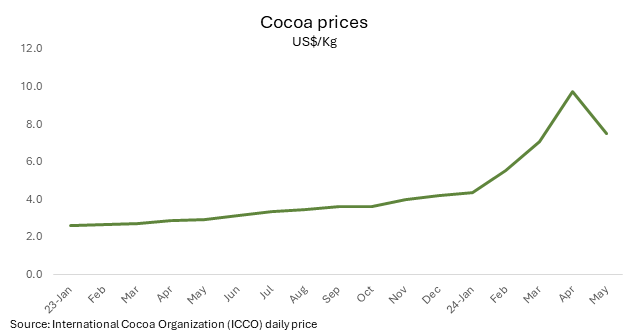

Meanwhile, in Q2 2024, the price of cocoa reached a record high of US$10.97 per kg. This significant decline in bean production triggered by climate change and El Niño, resulting in unpredictable rainfall and elevated temperatures in the four major producing countries in West and Central Africa, which account for more than 60% of the world’s supply of cocoa beans: Cote d’Ivoire (38%), Ghana (19%), Nigeria (5%), and Cameroon (5%), stimulated the spread of diseases and pests that affect cocoa trees, including black pod disease and cocoa swollen shoot virus disease (CSSVD).

These shocks brought on by the environment have collectively significantly decreased yields and price increase. Aging trees and other structural issues contribute to the limited supply. Moreover, the supply of cocoa beans in Ghana is further restricted by the shift in land usage to artisanal mining of gold and other minerals. There is mounting evidence that small-scale miners are leasing farmers’ cocoa fields, putting the production of cocoa in direct conflict with mining for labor and land.

Weather Concerns and Market Dynamics: Brazil’s Recent Floods, La Niña’s Impact, and Cocoa Price Surge:

As exhibited by the recent floods between April–May 2024 in Brazil’s Rio Grande do Sul, which hindered the harvest of corn and soybeans, harsh weather conditions are still a major concern. However, it is predicted that a transition from El Niño to La Niña will lessen the strain on commodities such as cocoa, sugar, and rice. The US National Weather Service stated in May 2024 that there is a 69% probability that La Niña will form between July and September of 2024. In 2024, increased plantings in Brazil and the US will significantly result in a decline in soybean prices. Following significant rainfall that impacted cocoa plantations in Côte d’Ivoire, the government promptly suspended the bidding process for cocoa export contracts for the 2023–2024 season.

In addition to harming foreign reserves, the sanctions impact major commodities trading companies that deal in cocoa, like Cargill, Barry Callebaut, Nestlé, and Hershey. The president then issued a directive on April 2 to hike farm gate prices by 50%, effective as of April 2, from FCFA 1,000/kg ($1.71/kg) to FCFA 1,500/kg ($2.57/kg), in response to farmer protests. For the remaining months of the 2023–2024 cocoa season, the government of Ghana raised producer prices by 58.26% as of April 5, moving them from GH¢20.93/kg ($4.70/kg) to GH¢33.12/kg ($7.61/kg).

In Q2 2024, metal prices increased, but the outlook is still gloomy.:

Industrial Metals and Gold Prices Surge Amid Economic Shifts and Geopolitical Uncertainties in Q2 2024:

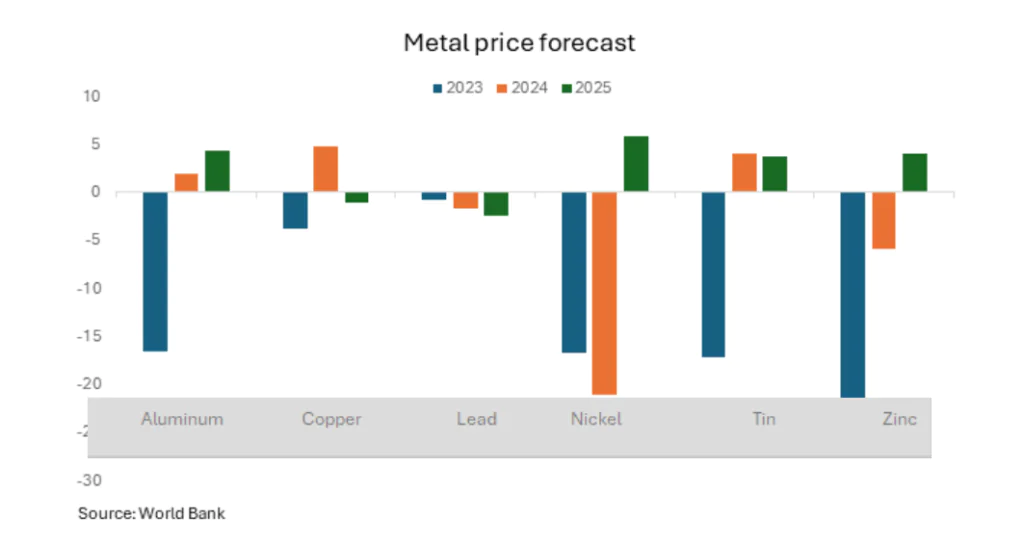

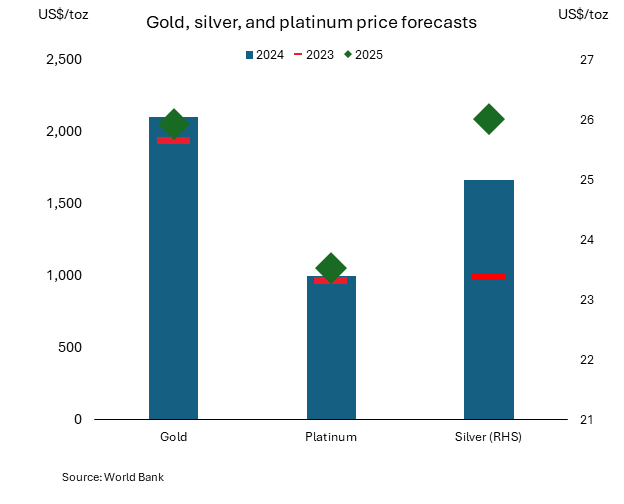

In Q2 2024, the prices for key industrial metals such as copper, aluminum, and tin began to rise again. The demand for metals is being supported by a strong US economy and indications of an economic revival in China. The price recovery was also aided by Chinese smelters reduced operating capacity, particularly in the aluminum markets. The central bank’s purchases and growing geopolitical unpredictability drove a spike in gold prices. Global central banks increased their gold stockpiles by 229 tons by the end of 2023, according to the World Gold Council. Increased market volatility in Q2 has increased the appeal of secure investments like gold, indicating a general sense of unease over the state of the world economy.

The US elections, the ongoing conflict in the Middle East, and the possible fallout from a Trump win have all contributed to an upsurge of market volatility. The appeal of safe-haven assets like gold has increased due to increased market volatility, which indicates general concern about the state of the world economy. Furthermore, the supply of copper and aluminum may become more limited due to trade restrictions, such as the recent prohibition on metals of Russian origin at significant commodities markets in the US and the UK. Given that both Indonesia and Myanmar account for 40% of the world’s tin output, in addition to the export limitations that the latter country imposed in February, tin supplies remain limited in Q2 2024.

In Q2 2024, China’s real estate sector’s prolonged downturn continued to impact the demand for metals used in construction, particularly steel and iron ore, which are crucial for property development. Given that high interest rates continue to hinder economic growth, demand outside of China remained subdued.

Copper Prices Set to Rise in 2024 Amid Supply Instability and Growing Speculative Demand:

Copper prices are anticipated to rise due to supply instability and growing speculative demand in 2024. Production cuts are putting the supply of copper at risk, and shortages are factored in as they are predicted to happen in 2025. One of the biggest copper mines in the world, located in Zambia, is at risk of running out of supplies due to First Quantum Minerals’ financial issues. The US and Chinese corporations are engaged in a bidding battle over the potential US$3 billion stake in Zambian copper mines. Considering copper is essential to the shift to green energy and helps fuel AI development, the biggest economies want to ensure a steady supply.

Gold demand is anticipated to persist through 2024 as nations like China, Poland, and India increasing their gold reserves. Nonetheless, the trajectory of gold prices in 2024 is still unknown due to the possibility of reduced inflationary pressures dampening investor demand.

Despite these tensions, the US economy is still proving to be resilient, which implies that the dollar will continue to strengthen in the upcoming quarter. This is expected to put financial strain on developing nations and emerging markets since the stronger dollar raises the cost of repaying large loans denominated in dollars in local currency. This might result in more severe economic difficulties in these areas.

Energy Market: Balancing geopolitical tensions, supply uncertainties, and demand fluctuations.

Navigating the Complexities of the 2024 Energy Market: Geopolitics, Demand Dynamics, and OPEC+ Strategies:

The energy market outlook for 2024 is shaped by various risks, both upward and downward. Geopolitical tensions and supply uncertainties are likely to exert upward pressure on energy prices. Conversely, softer global demand, influenced by a prolonged high-interest rate environment, is expected to limit energy demand and cap price increases.

In April 2024, crude oil prices reached a six-month high of US$87.67 per barrel, but eased significantly by more than 5% in May (US$76.15) due to concerns about sluggish global economic growth. The increasing likelihood of delayed monetary easing in major economies further dampened consumer and industrial demand. Additionally, the surge in electric vehicle (EV) sales, especially in APAC, Western Europe, and North America, is expected to reduce oil consumption, contributing to the downward pressure on prices.

As the energy sector continues to navigate these complex dynamics, stakeholders must stay informed and agile to effectively manage the evolving landscape.

Table: World oil demand in 2024*

| World oil demand | 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | 2024 | Growth 2023–2024 | |

| Absolute | % | |||||||

| Americas | 25.03 | 24.57 | 25.38 | 25.58 | 25.44 | 25.25 | 0.22 | 0.88 |

| of which US | 20.36 | 19.98 | 20.67 | 20.67 | 20.85 | 20.54 | 0.18 | 0.9 |

| Europe | 13.4 | 13.07 | 13.56 | 13.69 | 13.35 | 13.42 | 0.02 | 0.13 |

| Asia Pacific | 7.32 | 7.76 | 6.97 | 7.09 | 7.48 | 7.32 | 0 | 0.02 |

| Total OECD | 45.75 | 45.41 | 45.92 | 46.36 | 46.27 | 45.99 | 0.24 | 0.52 |

| China | 16.26 | 16.52 | 16.83 | 17.23 | 17.33 | 16.98 | 0.72 | 4.44 |

| India | 5.34 | 5.66 | 5.66 | 5.4 | 5.59 | 5.58 | 0.23 | 4.36 |

| Other Asia | 9.28 | 9.73 | 9.77 | 9.49 | 9.51 | 9.62 | 0.35 | 3.74 |

| Latin America | 6.69 | 6.75 | 6.88 | 6.97 | 6.88 | 6.87 | 0.18 | 2.69 |

| Middle East | 8.63 | 8.76 | 8.56 | 9.23 | 9 | 8.89 | 0.26 | 2.96 |

| Africa | 4.46 | 4.64 | 4.35 | 4.39 | 4.82 | 4.55 | 0.09 | 2.08 |

| Russia | 3.84 | 3.92 | 3.8 | 3.99 | 4.08 | 3.95 | 0.11 | 2.8 |

| Other Eurasia | 1.17 | 1.3 | 1.24 | 1.08 | 1.28 | 1.23 | 0.05 | 4.51 |

| Other Europe | 0.78 | 0.82 | 0.78 | 0.77 | 0.84 | 0.8 | 0.02 | 2.07 |

| Total non-OECD | 56.46 | 58.1 | 57.88 | 58.54 | 59.34 | 58.47 | 2.01 | 3.55 |

| Total World | 102.21 | 103.51 | 103.8 | 104.9 | 105.6 | 104.46 | 2.25 | 2.2 |

| Previous Estimate | 102.21 | 103.56 | 103.75 | 104.9 | 105.61 | 104.46 | 2.25 | 2.2 |

| Revision | 0 | -0.05 | 0.05 | 0 | -0.01 | 0 | 0 | 0 |

In June 2024, OPEC+ agreed to extend the cuts of 3.66 million bpd by a year until the end of 2025 and prolong the cuts of 2.2 million bpd by three months until the end of September 2024. OPEC+ will gradually phase out the cuts of 2.2 million bpd over a year from October 2024 to September 2025 amid tepid demand growth, high interest rates, and rising rival U.S. production.

In Q2 2024, natural gas prices continue to decline, with the European benchmark dropping to nearly half its level compared to a year ago. This decline is driven by sluggish industrial activity and favorable weather conditions that reduced demand.

2024 Energy Market Outlook: Stability and Risks Amid Geopolitical Tensions and Demand Dynamics:

Natural gas prices are anticipated to remain stable throughout 2024, driven by abundant production and high inventory levels, coupled with the growing adoption of renewable energy sources and efficiency improvements. Nonetheless, a potential increase in consumption in the power and industrial sectors due to lower prices, along with reduced US exports and higher demand from China and other Asian economies, presents an upward risk.

The geopolitical situation in the Middle East, including the Israel-Hamas conflict and the conflict between Israel and Iran, remains a crucial factor to watch. Intensifying tensions or potential escalations in the region could disrupt oil and gas production and exports, adding volatility to the energy market. These geopolitical dynamics are essential in determining the stability of global energy supplies.

Developments in the US, the world’s largest oil consumer, will significantly influence crude prices. Another decline in US oil inventories could trigger a bullish reaction, reflecting an improved outlook for energy consumption. Conversely, an increase in US inventories might signal slowing demand and put downward pressure on oil prices. OPEC and its allies may continue to adjust production levels to maintain crude price stability.

Recent price trends suggest the potential for further declines in crude prices, as the market forms a series of lower highs and lows. However, if oil prices defend the May low of US$76.15, range-bound conditions can be seen. Monitoring inventory levels, production adjustments, and geopolitical developments will be crucial for predicting future energy market trends. However, if the May low (US$76.15) fails to hold, the price of oil may decline toward the US$72.90 to US$73.20 range (78.6% Fibonacci retracement). The next area of interest is around US$71.50 (38.2% Fibonacci extension), just above the February low (US$74.41).