Procurement finance plays a vital role in establishing financial stability and growth for any organization. It involves managing the flow of funds between a company and its suppliers, ensuring mutual benefits for both parties. Procurement finance is a financial tool that enables companies to purchase goods and services efficiently. It helps them manage their purchasing costs, identify potential suppliers, and ensure the timely delivery of necessary goods and services.

Procurement finance is a financial tool that enables governments, businesses, and other organizations to purchase goods and services at a lower cost than they would otherwise. This is achieved by borrowing money from creditors to purchase the items or services. The benefits of using procurement finance include reducing the amount of money required to purchase goods, accelerating the item purchase process, and improving the overall quality of the end product.

Strategies that can support and enhance procurement finance

Proper negotiations can gain favorable prices for products or services:

Effective negotiation strategies can help procurement professionals secure favorable prices for products or services. Start by thoroughly researching the market, understanding the supplier’s cost structure, and setting clear objectives. Establishing a strong relationship with the supplier is essential, as it can lead to better terms. During negotiations, employ tactics such as anchoring (proposing the first offer), using silence to encourage concessions, and bundling deals for mutual benefit. Be prepared to walk away if terms are unfavorable. Continuous benchmarking and monitoring of market conditions will ensure ongoing competitiveness. Ultimately, a combination of research, relationship-building, and strategic tactics can lead to advantageous procurement deals.

Supply chain management can help in creating cost-saving opportunities:

Supply chain management plays a crucial role in cost savings by optimizing the flow of goods and services. It helps identify inefficiencies, reduce wastage, and enhance productivity. Strategic sourcing, for instance, allows for the selection of cost-effective suppliers. Inventory management minimizes carrying costs and the risk of obsolescence. Streamlining logistics can reduce transportation expenses. Lean production and demand forecasting aid in reducing overproduction and underutilized resources. Collaborative relationships with suppliers enhance negotiation power and reduce procurement costs. Overall, a well-managed supply chain contributes to leaner operations, reduced lead times, and improved efficiency, all of which lead to significant cost savings opportunities.

The use of data analytics can improve procurement finance:

Data analytics is essential to the financing of procurement. By examining past expenditure trends, industry developments, and supplier performance, businesses may find areas for improvement, make well-informed judgments, and enhance their procurement strategy. Demand forecasting models use historical data to prevent overstocking or understocking, reducing costs. Spend analysis identifies areas of cost reduction and negotiation opportunities, increasing efficiency. Risk assessment through data analytics identifies potential supplier vulnerabilities and mitigates disruptions. Furthermore, real-time data tracking streamlines inventory management and minimizes wastage. Overall, data analytics empowers procurement professionals to make strategic decisions, cut costs, and improve supply chain operations.

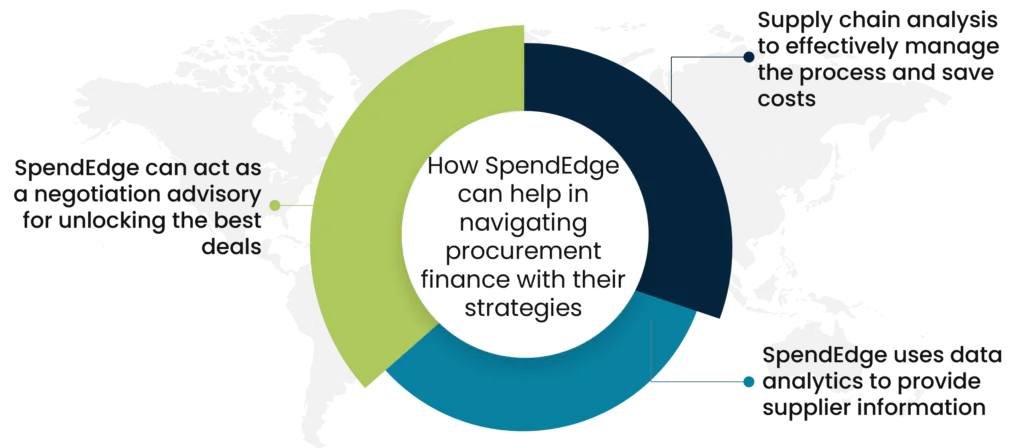

How SpendEdge can help in navigating procurement finance with their strategies

SpendEdge can act as a negotiation advisory for unlocking the best deals:

Our team of SpendEdge experts provides negotiation advisory services that help businesses identify opportunities for cost savings, favorable contract terms, and added incentives. This, in turn, maximizes the value derived from negotiations and boosts clients’ confidence and bargaining power. By engaging in our negotiation advisory services, clients can focus on their core responsibilities while we help them secure long-term cost savings by identifying ways to reduce expenses, improve terms, and secure favorable deals. Our planned approaches and techniques are tailored to aid in influencing negotiations to reach a mutually satisfactory agreement, saving time and resources in the process.

Supply chain analysis to effectively manage the process and save costs:

Our expertise in analyzing supply chains helps companies uncover cost-cutting opportunities that are typically hidden from sight, using supply-side insights. You can stay ahead of supply chain uncertainties with real-time risk notifications, and receive alerts when inventory exceeds or falls below predefined thresholds. Our analysis can help you obtain cost and pricing data to determine fair prices for suppliers. You can manage the supply chain activities by getting notified when commodity prices deviate from set limits. You can tailor data-centric backup plans for critical supply chain activities.

SpendEdge uses data analytics to provide supplier information, spend analysis, risk assessment, etc.

At SpendEdge, we leverage data analytics to assess supplier capabilities based on various criteria and obtain detailed information about supplier performance specific to each KPI. By using data analytics, we keep our clients up to date with the latest developments related to their potential and existing suppliers. Our spend analysis can help identify purchases from unauthorized suppliers and add transparency to organizational spend. This provides greater oversight of expenditure and reduces the likelihood of fraud. With our risk assessment services, we provide information about existing and potential risks facing the supply chain, and we determine the probability and severity of each risk profile, giving our clients the tools, they need to mitigate risks and ensure their supply chain is secure.

The success story of SpendEdge helping a pharmaceutical company

Our client a global pharmaceutical company based in the UK was facing the challenge of benchmarking payment days for its indirect categories, which encompass a diverse range of expenditures. They were unable to identify and understand the payment day standards adopted by industry peers proved to be a complex task. The company needed to establish effective escalation strategies to handle payment-related issues. The absence of well-defined SLAs for payments led to uncertainty in managing vendor relationships.

We conducted comprehensive research and analysis to understand the unique challenges and requirements of the company’s indirect categories. By leveraging industry insights and data, our team successfully compared the company’s payment days with those of its peers, providing a valuable benchmark for improvement. Our SpendEdge specialists developed a robust escalation framework that addressed payment-related challenges, ensuring prompt resolution of issues. The introduction of clear and structured SLAs for payments helped the company maintain transparency in vendor relationships and meet performance expectations.

The client was able to share the benchmark information with its suppliers to set SLAs and KPIs for its indirect procurement function.