By: Ankit Sood

Table of content

- Banking procurement trends

- How these current procurement trends play a strategic role in investment banking

- Here are some more trends in the banking sector

- One-stop solution – How SpendEdge can help

- Success Story: SpendEdge helped investment banking client

- Conclusion

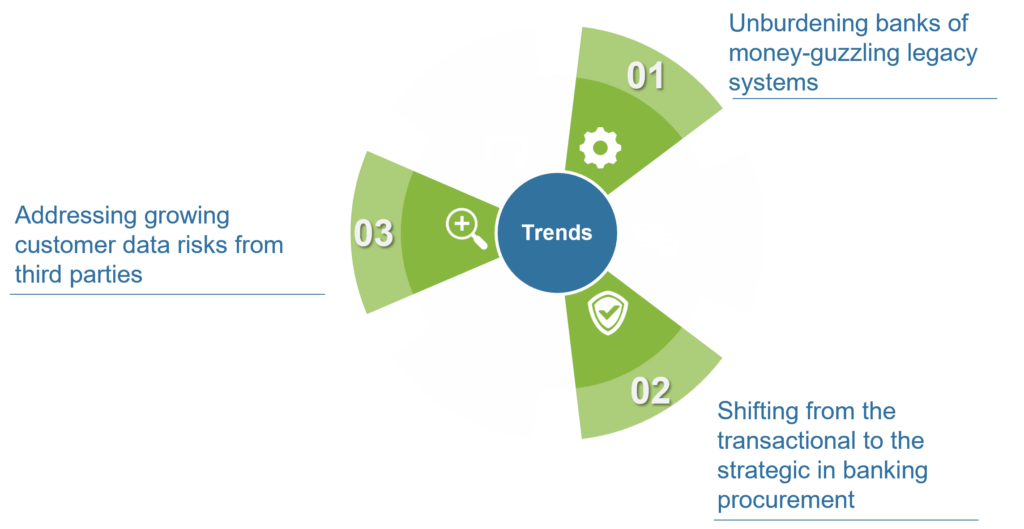

The good news, though long overdue, is that procurement is quietly finding pride of place at many investment banks as a top-tier organization-wide process capable of architecting long-term value for the firms at large in the mid-to-long term. The spend under management at a lot of investment firms is nearly 25-30%, which is all the more reason why procurement should no longer remain a transactional function. That said, CPOs in the sector have quite an uphill task ahead before they can realize the fruits of strategic procurement. Firstly, banks must shake off the legacy and tyranny of near-obsolete computing systems and hit top gear in their journey toward digital automation. While these are probably the best of times for procurement, self-limiting behaviors might well be holding back the function from reaching full fruition. So, a mindset shift from transactional to strategic is highly desirable. Finally, given the competitive pressures, banks can’t afford to let the benefits of outsourcing slip through their fingers. At the same time, concerns about third-party data risks could put a dampener on their outsourcing plans. Keep reading to stay on track with investment banking industry trends.

Banking procurement trends

1. Unburdening banks of money-guzzling legacy systems

Banks process trillions of dollars every day, and most of these transactions happen via antiquated computing systems, which have been around for more than three decades now and no longer have enough maintenance and support. The case is no different with the investment banking sector, and market participants are struggling to integrate legacy systems with latter day enterprise apps and get them to “talk” to each other. However, digital technology is permeating every sector without exception, and the leadership at investment firms know they cannot remain impervious to change. With born-digital investment services nibbling at the market, incumbent investment bankers are hurrying to embrace AI, ML, virtual “deal rooms,” and blockchain to give a new fillip to their activities, from consulting to investment banking.

2. Shifting from the transactional to the strategic in banking procurement

As mentioned earlier, banks have realized some degree of success in sourcing technology and operational support from a single supplier or a few suppliers, and such bundling translates to lower total costs and enhanced service quality. However, expecting this bundled approach to work across all categories is asking a bit too much. In reality, not many suppliers can ramp up quickly and deliver on a scale in response to consolidated purchase orders. The resulting supplier performance issues, such as late deliveries, back orders, fluctuating lead times and incorrect shipments, are financially draining banks, not to speak of the reputational impact on the brand. Suffice to say that CPOs in consulting or investment banking must actively embrace a holistic approach to enterprise spend, since the prevailing narrow field of view on procurement is limiting its capability to rein in costs and improve bottom lines.

3. Addressing growing customer data risks from third parties

Many of the Big-10 investment banks (like JP Morgan Chase, Bank of America, Morgan Stanley, Wells Fargo, Goldman Sachs) routinely hire staff in more cost-efficient countries in Asia and Eastern Europe to run critical back-office functions and operate call centers. In early 2022, JP Morgan Chase announced it was hiring nearly 6,000 people in India in areas like AI/ML, cybersecurity, cloud architecture, and data engineering. In the nearly two decades up to 2023, Goldman Sachs’ presence in India has gone from 300 people in IT and operations to 8,000 employees in tech, risk management, and investment banking advisory. Well Fargo’s 4,800-strong facility in the Philippines takes care of technology, operations, and knowledge services. Outsourcing often helps address critical skill shortages. Sometime back, Goldman Sachs was planning to outsource 1,000 high-paying roles in sales and investment banking to Singapore. The cost benefits of outsourcing are compelling, and peer pressure is drawing more businesses toward the practice. Nevertheless, there are concerns, not entirely misplaced, that sensitive information (e.g., social security number) might be shared offshore, handled by overseas staff, or end up in the hands of online crooks.

How these current procurement trends play a strategic role in investment banking

1. Enhance investment banking for the digital era

Historically, investing in state-of-the-art IT infrastructure has never really been top of mind for decision makers in the investment banking segment, but now they seem keen on making amends. To stay competitive and deliver consistently great customer service every single time, these firms are investing in relationship management platforms. With such “CRM for investment banking” in place, support teams get a centralized view of every interaction they have with a customer, and this helps them sharpen their focus on the customer and improve conversion rates. Meanwhile, the sales force gets leads, deadlines, and reminder alerts, all sorted and neatly organized, thanks to the software. The result is an appreciable decline in the number of potential deals falling through the crack. More and more investment bankers are leveraging AI tools to reduce cost and drive efficiency in functions like deal origination, due diligence, fraud detection, and customer service. At the same time, blockchain is showing the potential to eliminate intermediaries (such as in fund transfer), cut down the flab in functions like IT, compliance, risk management, and operations, thus paring spend by a third. Consequently, investment firms are warming up to this digital distributed ledger technology.

2. Protect and secure sensitive customer data

In March 2022, Bank of New York Mellon was hit with a record fine – $11.8 million! – by Ireland’s central bank for as many as 16 regulatory breaches, besides its failure to notify clients before kicking off outsourcing deals. In the light of expanding regulatory mandates, stakeholders want banks, in general, to take charge of their outsourcing activities. The interests of investment banks are best served by keeping the bulk of core functions, ranging from investment banking to consulting, in-house – since outsourcing these to an excess carries the risk of overreliance on a supplier or geographic location (the so-called concentration risk). On the other hand, banks must consider proactively shipping non-core functions (IT, operations, research support) to cost-efficient operators to be able to reap the benefits of not just cost arbitrage but also improved productivity and expanded talent pools. Banks must ensure unequivocal agreements on data confidentiality and integrity are baked into outsourcing contracts, with hefty penalties for compromising customer privacy. Where customer data is handled outside the home country, financial institutions must be honest and upfront with customers on this – rather than leaving such details tucked away in the fine print of the bank’s terms of agreement.

Take a long view on banking procurement – it’s about time

Essentially, the procurement organization at an investment bank must strive to seamlessly map segmented category-wise views of spend with forecasts of future demand and, furthermore, with the requirements of specific projects. Category management, demand planning, and project purchasing call for distinct skillsets, and a narrow focus on personnel with financial services expertise is no guarantee of success anymore. Bringing in the most desirable talent with demonstrated expertise in diverse industry groups (e.g., investment banking risk management, supplier management) and, further on, building on their knowledge and skillsets through continuous learning programs is essential to move the procurement function at investment banks up the value chain. “Procurement Maturity” is a demanding peak to ascend, but if scaled, the procurement organization will not just be able to understand and track spend as well as keep costs under control, but also ensure core procurement activities get all of its attention. With this, the procurement team should be able to drive lasting value across the enterprise.

Here are some more trends in the banking sector

1. AI in Banking

Artificial Intelligence (AI) has revolutionized the banking sector, driving efficiency, enhancing customer experience, and enabling better risk management. AI technologies such as machine learning, predictive analytics, and big data analytics are being utilized to automate routine tasks, detect fraud, personalize customer services, and optimize financial decisions. For example, AI-powered chatbots and virtual assistants provide customers with 24/7 support, handling inquiries and transactions efficiently. AI also plays a critical role in credit scoring and loan approvals by analyzing vast amounts of data to assess creditworthiness accurately. Furthermore, AI helps in regulatory compliance by automating the monitoring and reporting of transactions, thus reducing the risk of human error and ensuring adherence to financial regulations.

2. Robotics in Banking

Robotic Process Automation (RPA) is transforming the banking industry by automating repetitive, rule-based tasks that were traditionally performed by humans. Robotics in banking enhances operational efficiency, reduces costs, and minimizes errors. Tasks such as data entry, account reconciliation, and transaction processing can be performed faster and more accurately by robots. Banks are increasingly deploying RPA to handle customer onboarding processes, KYC (Know Your Customer) checks, and anti-money laundering (AML) compliance. This not only speeds up these processes but also allows human employees to focus on more complex and value-added activities. Additionally, robotics can improve customer service by ensuring consistent and error-free interactions, leading to higher customer satisfaction.

3. Natural Language Processing (NLP) in Banking

Natural Language Processing (NLP) is a branch of AI that enables machines to understand and respond to human language. In banking, NLP is used to enhance customer interactions and streamline operations. NLP-powered chatbots and virtual assistants can handle customer queries, provide account information, and assist with transactions in real-time, improving customer experience and reducing the workload on human agents. NLP is also used in sentiment analysis to gauge customer satisfaction and feedback from various channels like social media, emails, and surveys. This helps banks in understanding customer needs and improving their services. Additionally, NLP aids in fraud detection by analyzing unstructured data and identifying suspicious activities. It is also instrumental in compliance and regulatory reporting by processing and analyzing large volumes of text-based data to ensure adherence to legal standards.

One-stop solution – How SpendEdge can help transform your investment banking business with procurement and sourcing market intelligence

The technology space is dramatically evolving, so much so that businesses are struggling to stay up to date. Our experts help businesses choose the right technology to enable investment banking consulting from the myriad of trending platforms out there, keeping in mind their long-term needs, cost considerations, and sustainability agenda. We make sure these technologies are viable over the longer term, besides ensuring their compatibility with incumbent systems.

1. Address third-party data risks as a priority

An unhealthy obsession with supplier costs has many businesses chasing low-cost vendors who often cut corners on due diligence compliance. Unscrupulous third-party supply chain participants constitute the biggest source of reputational risk in investment banking outsourcing. Cost can never be a sole consideration for reckoning supplier risks, so taking a more detailed view of potential risks, including data risks, we assign accurate risk scores to suppliers.

2. Catapult the procurement function to strategic heights

Contrary to popular perception, sourcing can never be the “purchasing at the lowest cost” function. Over the years, our experts have elevated sourcing to its true status – that of a strategic and organization-wide process capable of delivering best-value goods and services to businesses when they need them while staying within budget. By so doing, we leverage investment banking analytics to provide businesses with the much-needed competitive advantage, going several extra miles beyond procurement efficiency improvements.

Success Story: SpendEdge helped investment banking client untap value with market intelligence and save procurement costs

Our client, a midsize American investment banking advisory, was facing competitive pressures in the home market, which threatened to hurt margins. Having seen peers outsourcing resource-intensive operations to cost-friendly destinations, the client hoped to emulate their example. While the client didn’t want to miss out on the cost advantages promised by outsourcing, potential risks to confidential customer data from third parties were weighing heavily on the client. Besides, consolidating operations with a third-party vendor might give rise to concentration risks, which was another major concern. After a full due diligence, the client began to work with our experts to resolve the raft of business issues it faced. And at stake was a considerably large addressable market in investment banking.

Applying our market research methodology, brought to perfection over nearly two decades, our team evaluated the client’s business requirements and identified several third-party business process outsourcing services (BPOs) in cost-effective locations like India and the Philippines. Our procurement specialists weighed in several factors and most of all, data security practices of these BPOs. The providers were shortlisted based on critical data security credentials (e.g., ISO certification, data security policies, multi-layer data security, customer and compliance protocols). This apart, our experts factored in the BPOs’ years of experience, credentials, delivery results, and fiscal stability. To sail clear of concentration risks, our experts recommended that the client retain most of its core functions in-house rather than ship these offshore. Furthermore, our specialists validated and tabulated research findings to narrow down to a shortlist of five BPOs. The timing was important for the client, and our team quickly wrapped up the entire exercise. The client has started working with one of the BPOs on our shortlist on a test project and early results are very encouraging.

Digitally transforming an investment bank’s procurement function can be easy as pie or frustratingly hard. It all boils down to who you are talking to and the experience and expertise in procurement transformation they bring to the table. To find out more on how you can digitally enable your procurement function, talk to our experts now.

Conclusion

The banking sector, particularly investment banking, is on the cusp of significant transformation driven by technological advancements, evolving procurement strategies, and a shift towards digital automation. The move from transactional to strategic procurement is essential for investment banks to realize long-term value and stay competitive in a rapidly changing market. Embracing technologies such as AI, robotics, and NLP is not merely a trend but a necessity to enhance operational efficiency, improve customer experiences, and manage risks effectively. Investment banks must also address the challenges posed by legacy systems, customer data risks, and the need for a strategic approach to outsourcing. By leveraging digital tools and adopting a holistic view of procurement, banks can navigate these challenges, streamline operations, and achieve cost efficiencies. Additionally, focusing on building robust supplier relationships, ensuring data security, and continuously innovating are critical to sustaining competitive advantage.

Author’s Details

Ankit Sood

Vice President, Sourcing and Procurement Intelligence

Ankit is working as a procurement specialist at Infiniti Research and has vast experience in leading market and procurement intelligence request for clients ranging across industries such as BFSI, CPG, F&B, Chemicals, and Pharmaceutical. He helps clients in solving procurement challenges related to supplier and competitive intelligence, cost optimization strategies, and overall market understanding.